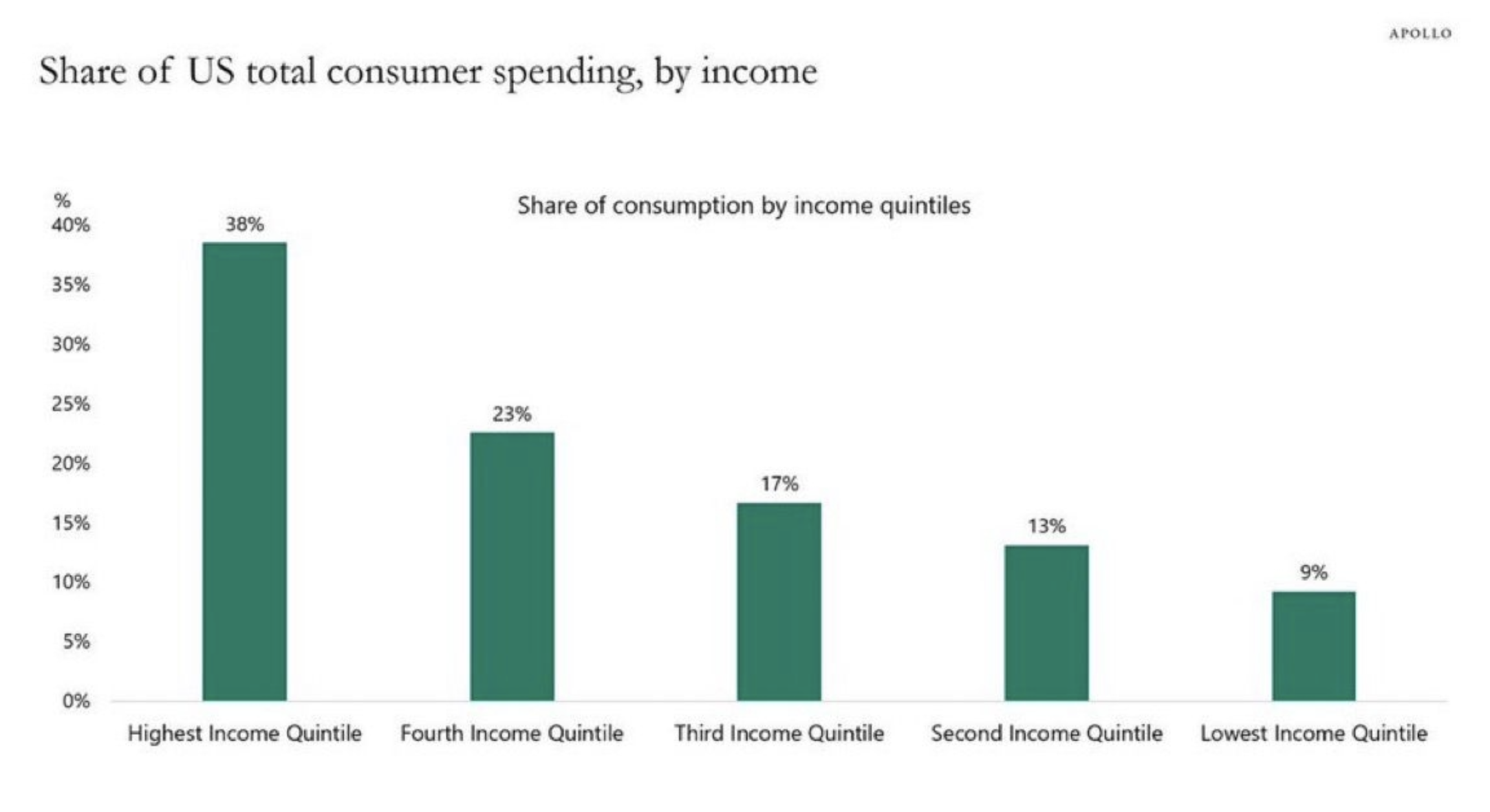

Per the chart below, it shows you who is spending and who is not.

The highest-earning 20% of people in the US now account for a huge 40% of all consumer spending.

On the other hand, the lowest-earning 20% of people only account for 9% of consumer spending.

Even if you add up the bottom 40% of incomes in the US, they still only account for 22% of consumer spending, compared to 61% for the top 40%.

Inflation has been over 3% for 37 months straight, and this has widened the wealth gap.

The people in the higher income groups have been able to keep up with inflation through rising real estate and stock prices.

Everyone else has been left behind and is struggling more with the high inflation.

In summary, the wealthy are spending a lot more while the poor are spending a lot less, and the wealth gap is growing due to persistent high inflation.

- Sanjay Research | InvestAnswers

The highest-earning 20% of people in the US now account for a huge 40% of all consumer spending.

On the other hand, the lowest-earning 20% of people only account for 9% of consumer spending.

Even if you add up the bottom 40% of incomes in the US, they still only account for 22% of consumer spending, compared to 61% for the top 40%.

Inflation has been over 3% for 37 months straight, and this has widened the wealth gap.

The people in the higher income groups have been able to keep up with inflation through rising real estate and stock prices.

Everyone else has been left behind and is struggling more with the high inflation.

In summary, the wealthy are spending a lot more while the poor are spending a lot less, and the wealth gap is growing due to persistent high inflation.

- Sanjay Research | InvestAnswers

Per the chart below, it shows you who is spending and who is not.

The highest-earning 20% of people in the US now account for a huge 40% of all consumer spending.

On the other hand, the lowest-earning 20% of people only account for 9% of consumer spending.

Even if you add up the bottom 40% of incomes in the US, they still only account for 22% of consumer spending, compared to 61% for the top 40%.

Inflation has been over 3% for 37 months straight, and this has widened the wealth gap.

The people in the higher income groups have been able to keep up with inflation through rising real estate and stock prices.

Everyone else has been left behind and is struggling more with the high inflation.

In summary, the wealthy are spending a lot more while the poor are spending a lot less, and the wealth gap is growing due to persistent high inflation.

- Sanjay Research | InvestAnswers

0 टिप्पणीहरू

0 शेयरहरू

1K भिउज

0 समीक्षा